arizona residential solar energy tax credit

Arizonas Solar Energy Credit provides an individual taxpayer with a credit for installing a solar or wind energy device or system at the taxpayers Arizona residence. For example if your solar PV system was installed before December 31 2022 installation costs totaled 18000 and your state government gave you a one-time rebate of 1000 for installing.

Federal Solar Tax Credit Guide Atlantic Key Energy

For upgrades installed before December 31 st 2019 the full 30 tax credit applies.

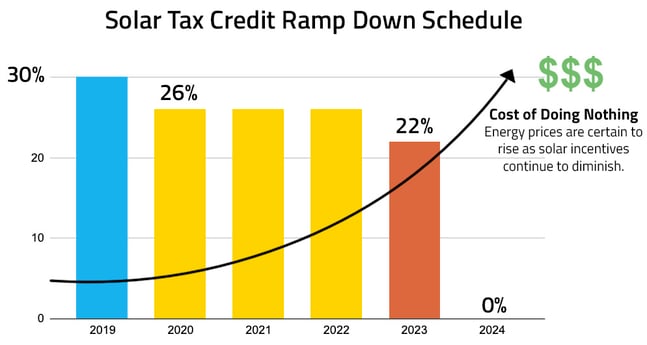

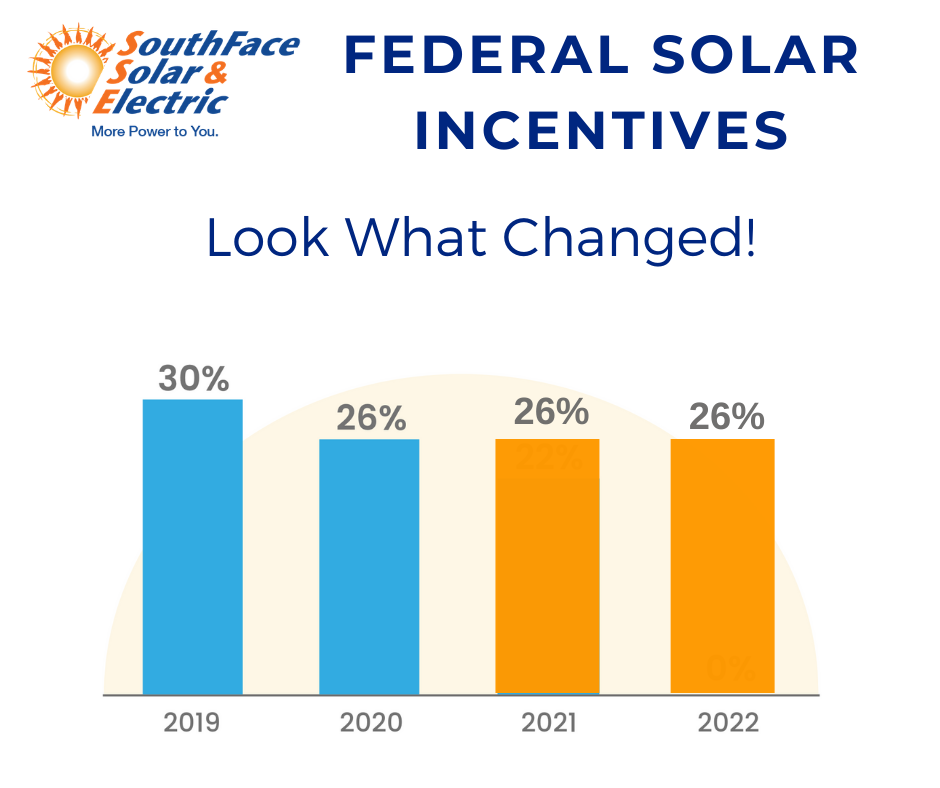

. As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable. In December 2020 Congress passed an extension of the ITC which provides a 26 tax credit for systems installed in 2020-2022 and 22 for systems installed in 2023. The Renewable Energy Production tax credit is for a qualified energy generator that has at least 5 megawatts.

Arizona law provides a solar energy credit for buying and installing a solar energy device at 25 25 of the cost including installation or 1000 whichever is less. Enter Your Zip Find Out How Much You Might Save. This applies to paying contractors and.

If you failed to claim the credit in a previous year you can file an amended return. Claiming the Solar Investment Tax Credit is worth 26 of the system cost. See Ratings Compare.

For systems installed after this date but before January 1 st 2021 the credits are worth 26. 1 day agoCurrently you can claim a federal residential solar energy tax credit of 26 of the cost of the system. An Arizona income tax credit is offered to businesses that install one or more solar energy devices.

Read User Reviews See Our 1 Pick. 2491 to extend the. Currently the residential solar tax.

Ad Find The Best Solar Providers In Arizona. Ad Get Solar Power For Your Home. Arizonas Solar Energy Credit provides an individual taxpayer with a credit for installing a solar or wind energy device or system at the taxpayers Arizona residence.

Arizona offers state solar tax credits -- 25 of the total system cost up to 1000. Cumulative solar energy credits allowed for the same residence cannot exceed 1000. Compare Quotes Online Today.

The credit is allowed. The solar tax credit is currently available at a rate of 26 through 2022 then at 22 for construction projects that begin in 2023. Arizonas tax credit for solar and wind installations in commercial and industrial applications was established in June 2006.

Income Tax Credit for Residential Solar Devices Wednesday March 16 2022 Phoenix AZ Homeowners who installed a solar energy device in their residential home. 23 rows A nonrefundable individual tax credit for an individual who installs a solar energy device in taxpayers residence located in Arizona. Ad Free Savings Calculation.

The credit is allowed. Check Rebates Incentives. Instead you can carry the credit over to tax year 2022.

See Ratings Compare. 9 rows Arizonas Solar Energy Credit is available to individual taxpayers who install a solar or. How Much Money Can Be Saved with this Tax Credit.

An income tax credit for the installation of solar energy devices in Arizona business facilities. Yes the residential energy efficient property credit allows for a credit equal to the applicable percent of the cost of qualified property. Application for Approval of Renewable Energy Production Tax Credit Note.

Qualifying properties are solar electric. Arizonas tax credit for solar and wind installations in commercial and industrial applications was established in June 2006. The residential tax credit is reduced to.

Enter Your Zip Find Out How Much You Might Save. Arizona law provides a solar energy credit for buying and installing a solar energy device at 25 25 of the cost including installation or 1000 whichever is less. The maximum credit a taxpayer may take for all solar energy devices installed in the same.

In May 2007 the credit was revised by HB. If you install a system in 2023 the credit goes down to 22. 2022s Top Solar Power Companies.

Ad Find The Best Solar Providers In Arizona. The credit is available to all non-residential entities who install.

Solar Generator Solar Panels Solar Generator Best Solar Panels

Federal Solar Tax Credit What Homeowners Need To Know This Old House

Is The Federal Tax Credit For Solar Panels Going Away In 2020 Solar Solution Az

No Act Of Kindness However Small Is Ever Wasted Pool Solar Panels Solar Pool Solar

Backup 1kw Solar Generator Powered By 240 Watt Solar Panel For Off Grid And Back Up Power 30 Fed Tax Credit Free Shipping Zonnepanelen Solar Energie

How The Solar Tax Credit Makes Renewable Energy Affordable

Federal Solar Tax Credit 2022 How It Works How Much It Saves

The Extended 26 Solar Tax Credit Critical Factors To Know

Attention Southern Nevada New Construction Buyers My Team And I Can Now Include Solar Into Your Mortgage Give Us A Call To Fi Las Vegas Homes Mortgage Solar

Information On Solar Energy Federal Tax Credits Northern Arizona Wind Sun

Solar Tax Credit In 2021 Southface Solar Electric Az

The Solar Investment Tax Credit In 2022 Southface Solar Az

Energy Solar Power House Solar Panels Solar Energy Panels

Arizona Solar Incentives Arizona Solar Rebates Tax Credits

Federal Solar Tax Credit 2022 How Does It Work Sunpro Solar

How Does The Federal Solar Tax Credit Work Freedom Solar